Auto Insurance in and around West Burlington

The West Burlington area's top choice for car insurance

Time to get a move on, safely.

Would you like to create a personalized auto quote?

Your Auto Insurance Search Is Over

Hailstorms, collisions and wind storms, oh my! Even the most attentive drivers know that sometimes trouble finds you on the road. No one knows what to expect around the next bend.

The West Burlington area's top choice for car insurance

Time to get a move on, safely.

Coverage From Here To There And Everywhere In Between

With John Korschgen's assistance, you'll get reliable coverage for your vehicles, from sedans to smart cars. And Agent John Korschgen can share more information about State Farm's savings options—such as our Drive Safe & Save™ and Steer Clear®—and a wide range of policy inclusions—such as Emergency Roadside Service (ERS) coverage and rideshare insurance.

Don’t let accidents slow you down! Reach out to State Farm Agent John Korschgen today and discover how you can benefit from State Farm auto insurance.

Have More Questions About Auto Insurance?

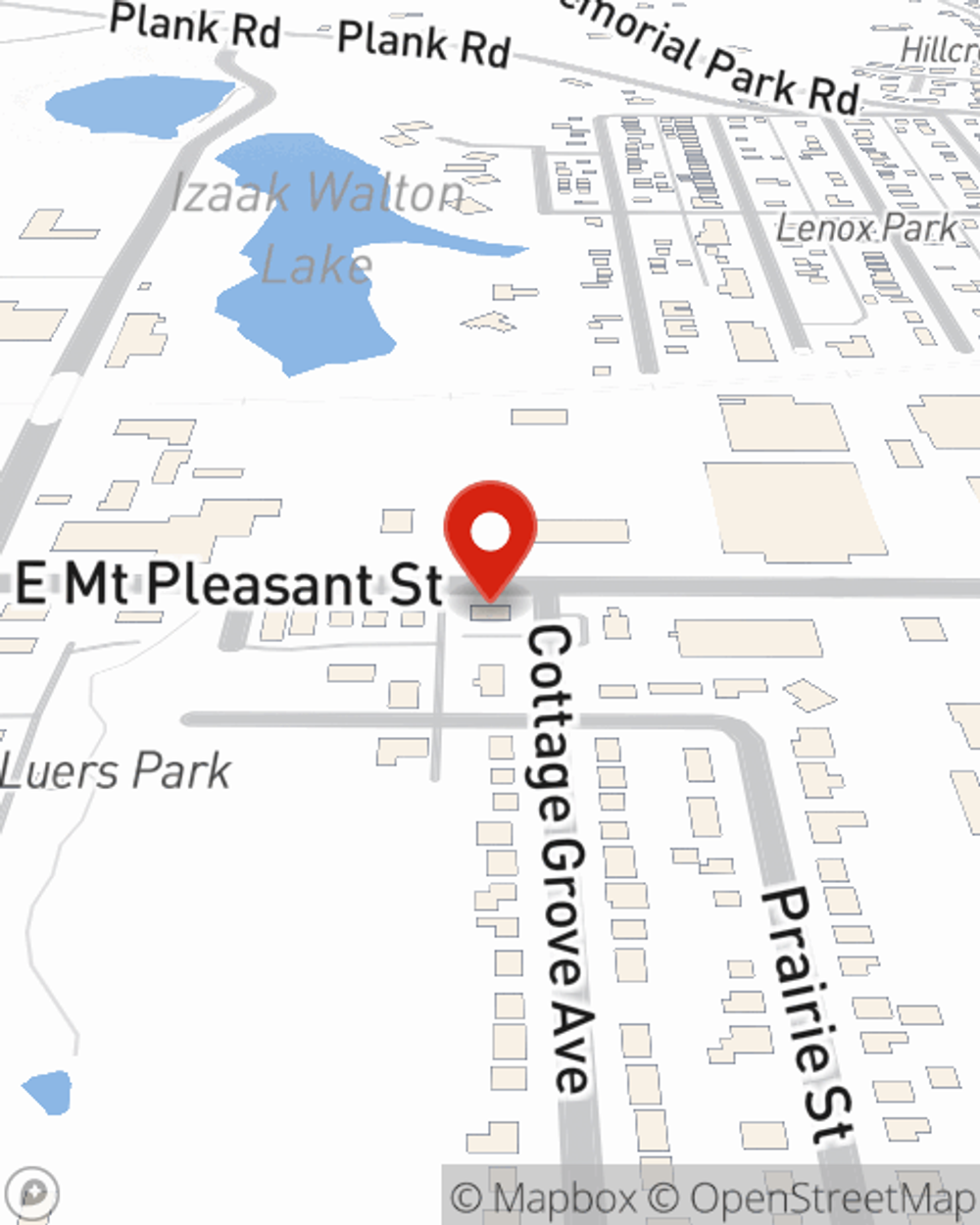

Call John at (319) 753-2886 or visit our FAQ page.

Simple Insights®

Quick steps to take if your gas pedal sticks

Quick steps to take if your gas pedal sticks

If your gas pedal sticks, do you know what to do? State Farm offers helpful tips on what to do, and on preventative technology such as Smart Throttle.

New car safety features to consider

New car safety features to consider

Choosing a car can take some time. Here are some car safety features to consider when you are looking to buy a new vehicle.

John Korschgen

State Farm® Insurance AgentSimple Insights®

Quick steps to take if your gas pedal sticks

Quick steps to take if your gas pedal sticks

If your gas pedal sticks, do you know what to do? State Farm offers helpful tips on what to do, and on preventative technology such as Smart Throttle.

New car safety features to consider

New car safety features to consider

Choosing a car can take some time. Here are some car safety features to consider when you are looking to buy a new vehicle.